We've got you covered!

With new changes in place as of 1/1/2026, wait times for processing are changing.

30-day data can be found on Silencer Shop's website

We have a great in stock selection

or Shop our Silencer Shop Webstore Inventory*

or we'll place a special order.

Updated: Silencer Shop submits the form 4s.

Reno Guns & Range certifies and assists with assignments.

If you think your form has been approved, you can call the ATF NFA Branch at (304) 616-4500.

Please note, for most NFA items, there is no physical tax stamp, so when we get them, they are instantly approved.

You cannot pick up your item until you have approval. Once received, we will contact you to come in and complete the final paperwork.

*For the best prices on the Silencer Shop website,

Please make sure Your Selected Dealer is Reno Guns & Range

All the following information is accurate and reflects ATF resources as of 9/1/2017

The NFA was originally enacted in 1934. Title II of the Gun Control Act (GCA) of 1968 amended the NFA to cure a constitutional flaw and amended a few NFA definitions. In 1986, the Firearm Owner's Protection Act amended the NFA definition of "silencer" and the GCA to prohibit certain machine gun transfers or possession. Please refer to the ATF's website for additional information and FAQs: https://www.atf.gov/qa-category/national-firearms-act-nfa

As of January 1, 2026, NFA-regulated items, including suppressors (silencers), short-barreled rifles (SBRs), short-barreled shotguns (SBSs), and any other weapons (AOWs), no longer require the $200 tax stamp due to the passage of the One Big, Beautiful Bill (OBBB) under Section 70436. While the tax fee for these has been eliminated, the full NFA application process—including ATF Form 1 or Form 4, fingerprints, passport-style photos, background checks, and registration—still applies. In addition, Machine guns and destructive devices (DDs) still require the $200 tax stamp under the National Firearms Act (NFA).

Still require the form and $200 tax stamp under the National Firearms Act (NFA):

- - Machine guns

- - Destructive devices (DDs)

Still require the form BUT NOT subject to the $200 tax stamp:

- - Suppressors (silencers)

- - Short-barreled rifles (SBRs)

- - Short-barreled shotguns (SBSs)

- - Any other weapons (AOWs)

- There is a $200 transfer tax on machine guns and Destructive devices. The full ATF application process remains mandatory.

- There is no transfer tax on Suppressors/Silencers, SBRs, SBSs and AOWs, however the full ATF application process remains mandatory.

The full application process is digital and includes:

Fingerprint submission

Passport-sized photo

- Approval from the ATF

The time required to process an NFA application depends upon many factors including the particular ATF form used, the volume of forms submitted from throughout the country, any errors on forms, and complexities with background checks or the legal status of corporations, trusts or other legal entities.

Commonly ownership is in the name of an individual or trust, however partnership, company, association, estate, or corporation ownership may be a consideration. We'll be happy to refer you to a local attorney who specializes in NFA law.

- A person may make an NFA firearm by filing and receiving an approved ATF Form 1 Application to Make and Register a Firearm.

- Applications to make or transfer a firearm will not be approved if Federal, State, or local law prohibits the making or possession of the firearm.

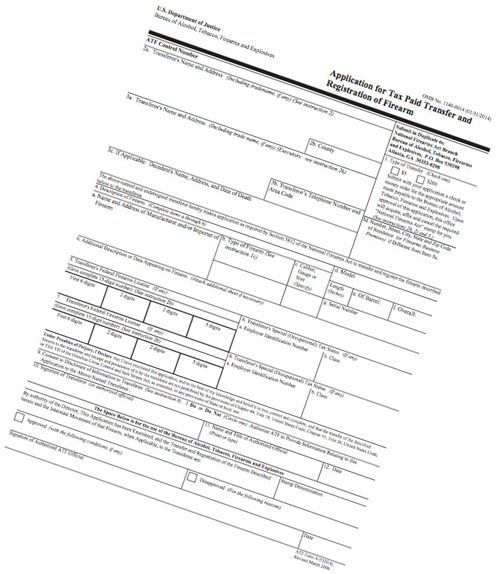

- A person may transfer an NFA firearm to another person by filing and receiving an approved ATF Form 4, Application for Tax Paid Transfer and Registration of Firearm. This is also known as ATF Form 5320.4. In addition to completing the form, you need to provide the required documents for Individual filing OR Trust/Corporation filing

Silencershop - How to buy a Silencer

Don't forget to select Reno Guns & Range as your dealer!

Reno Guns & Range

2325 Market St

Reno, NV 89502